[STATUS: NON-ERGODIC]

CURRENT MODELS FAIL TO ACCOUNT FOR SYSTEMIC RISKS AND OPPORTUNITIES. WE BUILD THE ON-RAMP TO AN ECONOMY THAT WORKS FOR ALL LIFE.

BREAKTHROUGH

Ergodicity Economics

STRUCTURE

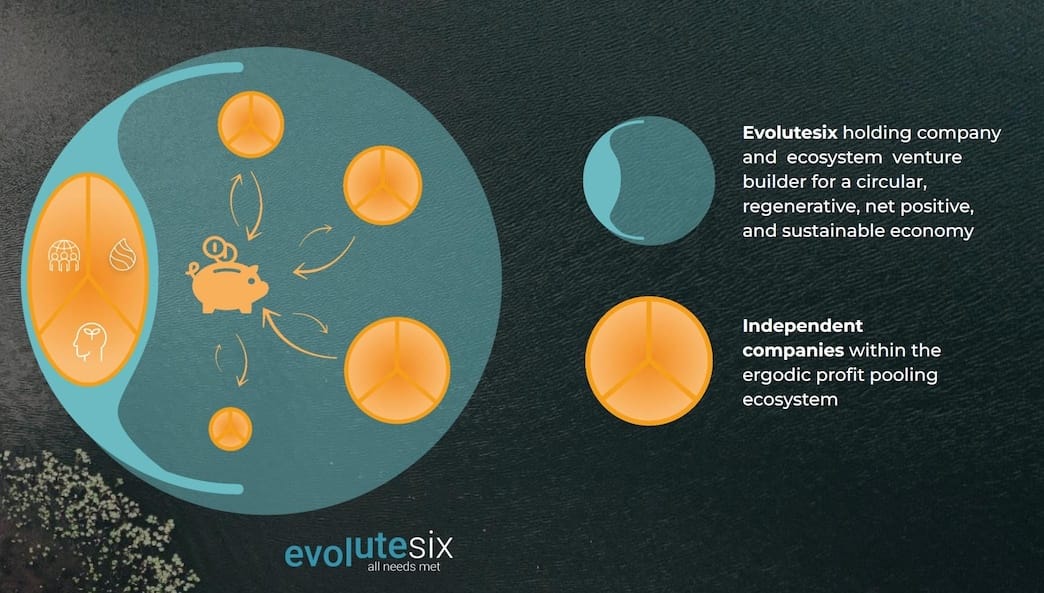

Profit-Pooling SYSTEMS

VALIDATION

48+ Ventures

RESILIENCE DATA

92% modeled success rate vs. ~8% industry baseline

Portfolio theory unknowingly assumes ergodic growth. Real markets are non-ergodic. This fundamental error destroys $200B annually.

[PORTFOLIO: CONNECTED ECOSYSTEMS]

Interconnected ventures share resources dynamically. We replace isolated risk and opportunity with distributed resilience. Strategically optimise the space between companies that currently is left to chance.

Patterns replicate across the network at all scales. Proven strategies spread instantly through the ecosystem.

Risk and opportunity is mathematically distributed. Every node contributes to the stability and growth of the whole.

A living commons that distributes governance and wealth equitably. Shifting incentives from ownership percentages to absolute value growth. The minimum needed for a company to be truly systemic, for a company to be a strong player in an economy that works for all life: regenerative, doughnut, circular, etc. economy

ENGINE FOR

Ergodic Organisations

John Fullerton,

Capital Institute, Former JP Morgan MD

Our talk with Dr. Steve Keen, Dr Graham Boyd, and Bert Hofman revolves around the inadequacy of traditional equilibrium-based economic models.

Only an ergodic strategy, one with some form of financial pooling between the companies, is capable of getting you as close as mathematically achievable to risk-adjusted returns.

Many economic theories focus on competition over co-operation, leading to wasted materials and energy. By introducing methods to pool resources, we can thrive.